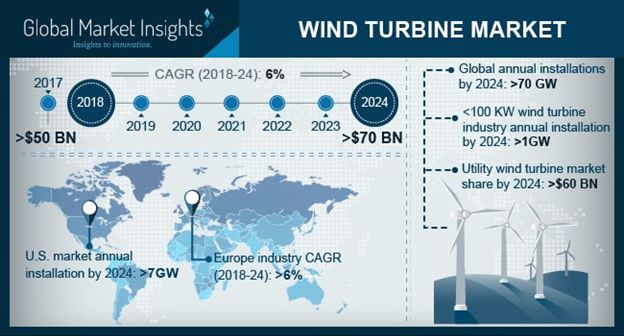

According to the latest research report by Global Market Insights, the global wind turbine market is expected to exceed $70 billion by 2024.

The increased investment in effective R&D of wind power technology and the increased acceptance of large-capacity projects will affect the overall product price. With operational efficiency and mass production, increasing industrial competition has led to a significant drop in the price of rotor modules. In addition, improved blade size and tower height to match effective resource operations will have a positive impact on global market dynamics.

The global wind turbine market is affected by the existing industrial system due to the increasing energy demand of private wind farm companies and utilities-assisted renewables. The balance between demand and supply has been a major concern for private utilities and industry participants, which in turn has increased investment in sustainable power plant development.

The ability to generate power under turbulent conditions, combined with simple operational activities and low maintenance costs, are some of the basic features that change the market share of horizontal axis wind turbines. In addition, the effective viability of residential applications with low rated capacity observed through aggressive consumer prospects will nourish vertical axis unit deployment.

The use of distributed generation technology associated with aging energy applications will power the market share of wind turbines greater than 2 megawatts. Increasing efficiency, reducing costs, and low emissions through enhanced technological proximity are important parameters driving the adoption of these devices. In addition, current technological developments, including increased efficiency and flexibility in recovery and non-recovery units, will further impact industry prospects.

Compared to grid-connected power networks, the off-grid wind turbine market will grow in connection with operational and economic viability in remote areas. Government programs related to rural electrification programs, coupled with the increasing popularity of microgrids, will further boost business growth. Low installation costs and government plans and incentives (including net metering and FiT) will increase demand for online products. To meet the growing energy needs of industrial and residential areas, the rapid development of utility-based power deployment will further stimulate industry growth.

By 2024, the offshore wind turbine market is expected to exceed $16 billion. A positive regulatory bias coupled with long-term integration goals will drive the development of the offshore wind industry. Higher efficiency and cost effectiveness are some of the basic parameters that complement industry dynamics. Improved business activity statistics will further increase technology requirements compared to peers.

Due to the increase in domestic system production, component cost reduction and the established goal of increasing renewable energy capacity, it is estimated that the annual installed capacity of the US wind turbine market will exceed 7 GW by 2024.

By 2024, the annual installed capacity in the European market will exceed 20 GW. Compared with traditional energy sources, cost efficiency, low carbon emissions and competitive power generation tariffs are necessary parameters that affect the adoption of wind power technology. In 2017, Europe added 16.8 GW of wind power installed capacity, with an offshore installed capacity of 3,154 megawatts and an onshore installed capacity of 1,484 megawatts.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite