Basic concept and industrial chain of civil shipbuilding industry

Shipbuilding is a large-scale equipment manufacturing industry with high complexity and comprehensiveness. As a flowing land, a ship is equivalent to a miniature and complete maritime town. On the ship, not only must it achieve various professional functions, but also ensure the crew's various living needs.

Therefore, in addition to final assembly manufacturing, the shipbuilding industry also has a large supporting system involving a large number of complex equipment and systems, such as power systems, electromechanical systems, electronic communication systems, specialized equipment and systems, etc.

Civil ships can be divided into transport vessels, engineering work vessels, fishing vessels, etc. according to their purposes.

Transport vessels: They can be divided into passenger ships and cargo ships. Cargo ships mainly include dry bulk carriers, oil tankers, container ships, refrigerated ships, ro-ro ships, LNG ships, and barge carriers. Passenger ships can be divided into ordinary passenger ships and passenger rolling ships. Luxury cruises, etc.

Engineering work vessels: divided into dredgers, crane vessels, navigation vessels, cable drums, survey vessels, icebreakers, fireboats, porters and so on.

Fishery vessels: divided into fishery vessels, fishing boats, fishery auxiliary vessels, etc. Among them, the most widely used and the largest proportion of tonnage in commercial fleets are dry bulk carriers, oil tankers and container ships in transport vessels. These three types of ships have also become the three mainstream ship types.

Shipbuilding industry chain

The shipbuilding manufacturing industry is in the midstream manufacturing chain of the industrial chain. Its upstream industries include raw materials, ship design, ship support, etc. Its downstream customers are shipping companies or leasing companies.

Raw materials mainly refer to steel, alloy materials and special materials; ship design can be divided into basic design, detailed design, etc.;

Ships are more complex and can be divided into ship power system, marine power electrical system, deck machinery, marine armored equipment, marine communication and navigation system, ship automation system, cabin equipment, ballast water system, marine piping system, special equipment, etc. Ship Finance provides shipbuilding companies and shipping companies with financial services such as buyer and seller credits and guarantees.

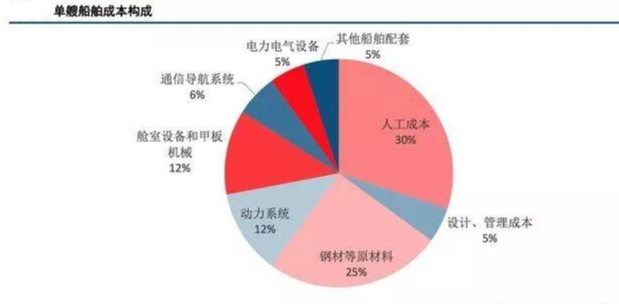

Ship cost structure

Labor costs account for about 30% of the total ship cost, raw materials such as steel account for 25% of the total ship cost, design management costs account for 5% of the total ship, and ship support accounts for about 40% of the total ship cost. Shipbuilding and raw materials account for a considerable proportion of the cost of the entire ship, and about 65% of the cost of the shipbuilding assembly enterprise needs to be outsourced.

The ship market enters the stage of the mid-cycle recovery, and the long-term prosperity will take time

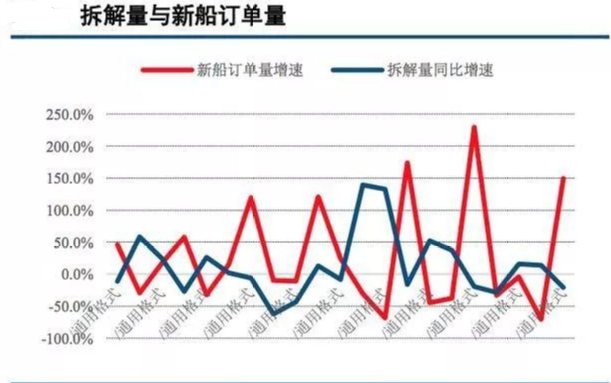

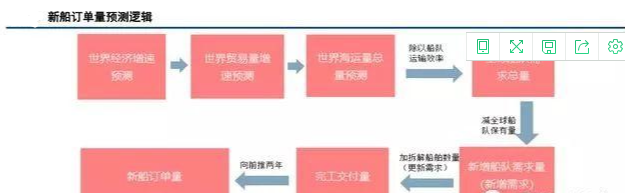

The civil ship market is a market with high degree of internationalization and full competition. The order of new ships is determined by the relationship between demand and supply. From the demand side, the global economic growth rate is highly correlated with the growth rate of seaborne volume, and the volume of shipping has a magnifying effect on the global economy. Changes in seaborne volume directly affect the demand for global fleets, which in turn affects new ship orders. From the perspective of the supply side, the difference between the fleet ownership and the demand after considering the dismantling amount is the demand for newbuilding.

Industry Status

First, the demand is low and the oversupply is oversupply. The ship market has experienced a decade of lows.

Since 2008, the ship market has entered a period of 10 years of depression, and the three major indicators of shipbuilding have fallen sharply. The current crisis of the ship market was caused by the combination of the sluggish demand side and the surplus of supply side, making the ship market crisis the longest and most influential crisis in previous crises. In this crisis, China's shipping companies generally face difficulties in receiving orders, difficulties in delivery, difficulty in financing, and difficulty in making profits. A large number of enterprises have gone bankrupt.

Second, the current ship market has entered a small recovery phase of the mid-cycle, and long-term prosperity will take time.

In the first quarter of 2018, with the improvement of the fundamentals of supply and demand, the ship market recovered slightly, and the overall market showed a situation of rising prices. We judge that due to the lack of long-term stable economic growth momentum, the current ship market will be in a small recovery phase of the mid-cycle, and there is still a long way to go from the long-term prosperity. At present, there is no strong driving force such as the explosive growth of China's trade volume before 2008, and the high point of this round of ship cycle is difficult to return to the peak before 2008. Along with the slight increase in prices, the new shipbuilding market may reach a market equilibrium with a lower order volume.

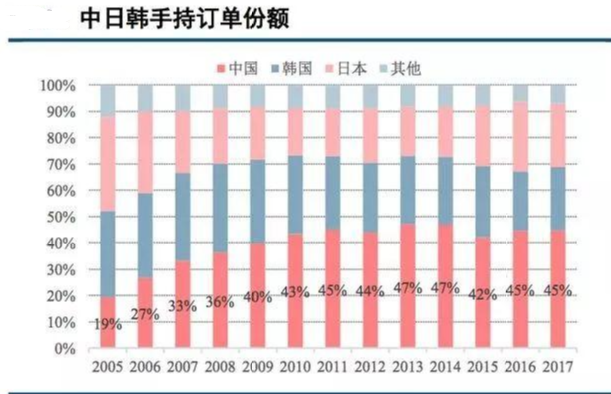

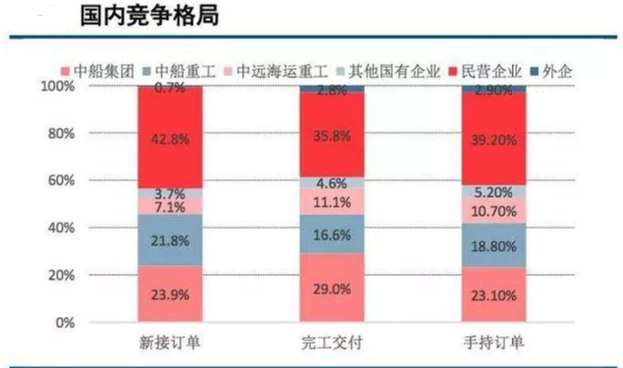

Third, the competitive landscape: China is difficult to be a country in the short-term, state-owned private enterprises

China has become the world's largest shipbuilding power, but it is still not a shipbuilding power. From the perspective of the three major indicators, China has become a veritable world's largest shipbuilding power. From a competitive point of view, Japan and South Korea are still in a leading position in terms of quality and efficiency, and it will take time for China to catch up. In the medium and long term, China, Japan and Korea have their own advantages in shipbuilding competitiveness. In the short term, China will be difficult to be a country. China, Japan and South Korea will continue to be in a three-pronged situation for a long time to come.

Fourth, the industrial concentration has been continuously improved, and high-quality private enterprises and state-owned enterprises have stood up to court.

In 2017, the share of orders received by private enterprises increased substantially, indicating that the private enterprises have stronger market competitiveness. The receipts of the three major state-owned enterprises still account for half of the total, but the share of orders has declined compared to 2016. Under the influence of the ship market crisis, a large number of ship companies have undergone bankruptcy and reorganization, the competition pattern has been reconstructed, and the industrial concentration has increased. It is expected that the merger and reorganization of China's shipbuilding industry will increase in the future, and the industrial concentration will be further improved. At the same time, many ship companies realized that the long-term fluctuations in the ship market have a greater impact on enterprises and began to develop diversified businesses to counter cyclical risks.

5. From the perspective of the future competition pattern, the competitive situation between state-owned enterprises and high-quality private enterprises will continue.

State-owned enterprises have comparative advantages in research and development strength and policy preferences, while private enterprises have advantages in management efficiency and cost control. We believe that in the future, China's shipbuilding industry will form three major state-owned shipbuilding groups (CSSC, CSIC, COSCO Shipbuilding) and 3-5 competitive large-scale civil shipbuilding groups (Jiangsu Yangtze River, New Age Shipbuilding, etc.) Competitive market structure.

Future development trend: the internal and external favorable factors superimposed, the fundamentals gradually improved

Although the shipbuilding industry is still in a difficult period, we believe that the fundamentals of the shipbuilding industry are gradually improving. Positive changes have taken place in the current external environment of the shipbuilding industry and within the industry. There are three main advantages to the external environment:

First, shipping is still the most important mode of transportation for international trade. With the global economic recovery, the demand for sea freight will grow steadily. In the medium and long term, the shipbuilding industry still has a large market space;

Second, the international marine environmental protection rules are becoming more and more stringent, bringing new demands to marine energy-saving and environmental protection equipment, and also bringing certain renewal requirements to the entire ship;

Third, China's policy support for the shipbuilding industry is still relatively large. From the perspective of internal factors, the release of reforms such as the supply-side reform of the shipbuilding industry and the reform of the central enterprises' mixed ownership system will effectively improve the quality of the shipbuilding industry and fully stimulate the enterprise's own endogenous power.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite