On the one hand, the intensification of the epidemic in Malaysia has led to tight production and supply of automotive-grade chips, and the shortage of corporate chips has further intensified. At the same time, due to the high base in the same period, the year-on-year decline in passenger car production and sales has increased compared with the previous month; on the other hand, the national six emissions Short-term market fluctuations caused by the switch of regulations continue to affect the demand for trucks, and the production and sales of commercial vehicles continue to decline rapidly.

"Although the shortage of chips significantly affected the company's production plan, the cumulative production and sales of automobiles still showed a slight increase compared with the data of the same period in 2019. At present, the supply of automobile products is mainly insufficient, and the terminal market demand remains stable. Commercial vehicles are affected by this July 1st. The switch to the National VI emission regulations for heavy-duty diesel vehicles has caused fluctuations in the commercial vehicle market. However, light passenger vehicles continue to maintain rapid growth, which drives passenger vehicles to continue to grow.” Chen Shihua, Deputy Secretary-General of the China Association of Automobile Manufacturers analyzed.

According to its forecast, "In the fourth quarter, the shortage of chips caused by the overseas epidemic will still exist, and the increase in market demand in the fourth quarter will also exacerbate the problem of limited supply; at the same time, fluctuations in commercial vehicle market demand and continued high raw material prices will all Further increase the cost pressure of enterprises and affect the operation of the industry. Based on various factors, it is preliminarily predicted that the market for the whole year may be weaker than expected."

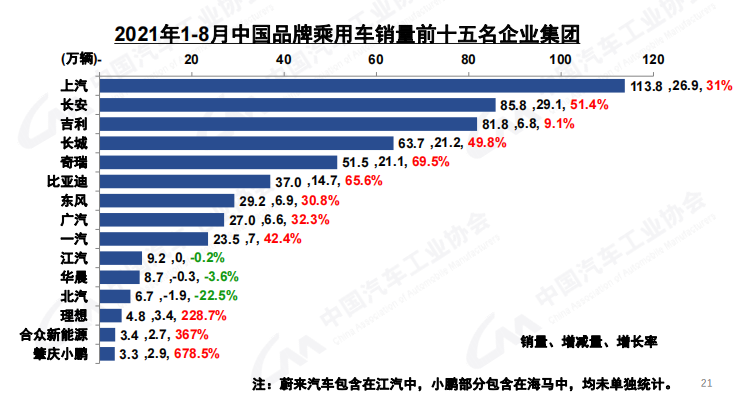

The market share of Chinese brand passenger cars has risen sharply

Since late July, industrial enterprises have continued their stable recovery and are facing challenges. Among them, the spread of epidemics in some parts of the country has been superimposed by the impact of overseas epidemics, and the production and supply of some enterprises have been hindered. The prices of bulk commodities are generally operating at a high level, and the pressure of rising corporate costs has gradually appeared, especially in the middle and lower reaches. The profitability of small and micro enterprises is constantly being squeezed. In this context, the operating pressure of the automotive industry has increased.

The monthly production and sales of passenger cars have fallen more than the same period last year. In August, the production and sales of passenger vehicles were 1.497 million and 1.552 million, with production down 3.3% month-on-month, sales increased by 0.04% month-on-month, down 11.9% and 11.7% year-on-year, respectively, and the rate of decrease was 1.2 percentage points and 4.7 percentage points larger than that in July. percentage point. In terms of vehicle types: Among the four types of vehicle models, only the crossover passenger car production and sales increased, and the production and sales of the other three types of vehicle models declined. Compared with 2019, passenger vehicle production and sales dropped 11.7% and 6.2% year-on-year. At present, passenger cars are showing a development trend of mismatch between supply and demand, in which market demand is relatively stable, but the supply side has reduced a certain amount of production due to chip shortages.

In August, the sales of Chinese brand passenger vehicles declined slightly from the previous month, and increased slightly year-on-year. A total of 704,000 vehicles were sold, down 1.6% month-on-month and 6.8% year-on-year, accounting for 45.3% of total passenger car sales. Among the major foreign brands, compared with July, the sales of German-based and American-based passenger cars have shown rapid growth, while other foreign brands have shown a decline, among which the decline of Japanese-based brands has been more pronounced; compared with the same period in 2020, French-based sales have continued to maintain High-speed growth, the US-based growth rate is slightly slower, and other foreign brands have shown a rapid decline.

In August, the market share of Chinese branded cars, SUVs and MPVs was 35.1%, 49.8% and 72.9%, respectively. Compared with July, the market share of Chinese branded sedans and MPVs has increased, while Chinese branded SUVs have shown a certain decline; compared with the same period in 2020, the market share of Chinese branded sedans, SUVs and MPVs has continued to grow, among which Chinese branded sedans The market share has increased more obviously.

From January to August, the total sales volume of Chinese brand passenger vehicles was 5.612 million, an increase of 36.7% year-on-year, and the market share was 42.8%, an increase of 6.5 percentage points. The market share of Chinese branded cars, SUVs and MPVs were 29.0%, 51.6% and 68.0%, respectively. Compared with the same period in 2020, the market share of Chinese branded cars, SUVs and MPVs have all increased.

Commercial vehicle production and sales dropped sharply, trucks dropped significantly

The production and sales of commercial vehicles dropped sharply year-on-year. Among them, the production and sales of trucks fell sharply year-on-year, and the production and sales of passenger cars continued to grow year-on-year.

Compared with the same period in 2019, the production and sales of commercial vehicles dropped by 23.1% and 19% year-on-year, and the growth rate has changed from positive to negative compared to July. Due to the switching of the National VI emission regulations for heavy diesel vehicles on July 1 this year, and the early overdraft consumption caused by the promotion of National V vehicle models since 2020, the market demand for trucks has fluctuated greatly this year, which has shown a clear trend of high first and low low. .

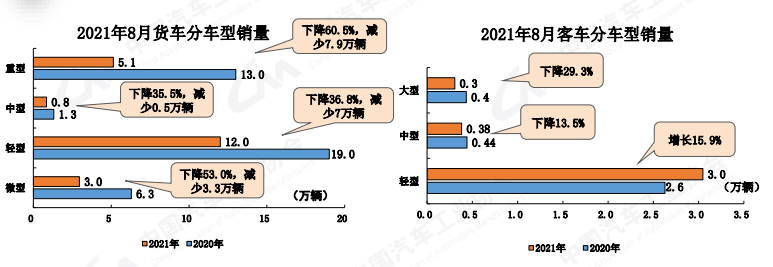

Sales breakdown of trucks and buses in August 2021

In August, the production and sales of commercial vehicles were 229,000 and 247,000, down 27.5% and 20.9% month-on-month; down 46.2% and 42.8% year-on-year, respectively, and the rate of decline continued to increase significantly by 13 percentage points and 12.6% respectively over July. Among the main types of commercial vehicles, compared with July, the production and sales of trucks and buses continued to decline, and the decline in trucks was even more pronounced. Compared with the same period in 2020, the production and sales of passenger cars increased slightly, and the sales of trucks showed a rapid decline.

In August, the sales volume of trucks was 210 thousand, a decrease of 23.7% month-on-month and a year-on-year decrease of 47.1%. Among the subdivisions of trucks, the production and sales of the four categories of trucks both declined month-on-month and year-on-year, with heavy trucks and mini trucks experiencing a more pronounced decline. In August, the sales volume of heavy trucks was 51,000, a year-on-year decrease of 60.5%, a decrease of 79,000; the sales of medium-duty trucks were 8,000, a year-on-year decrease of 35.5%, and a decrease of 5,000; the sales of light trucks were 120,000, a year-on-year decrease of 36.8%. A decrease of 70,000; the sales volume of minivans was 30,000, a year-on-year decrease of 53.0% and a decrease of 33,000.

Among the passenger car types, the production and sales of medium-sized passenger cars have increased rapidly compared with July, while large- and light-duty passenger cars have declined; compared with the same period in 2020, the production and sales of light-duty passenger cars have maintained rapid growth, and the production and sales of large and medium-sized passenger cars have decreased more. obvious.

From January to August, the production and sales of commercial vehicles were 3.275 million and 3.44 million, an increase of 0.6% and 5.5% year-on-year, and the growth rate was significantly lower than that from January to July. Among the main types of commercial vehicles, compared with the same period in 2020, the production and sales of passenger cars have maintained rapid growth, the output of trucks has decreased slightly, and the sales volume has increased slightly. Among the main types of trucks, compared with the same period in 2020, the production and sales of mini trucks have shown a rapid decline, medium trucks have maintained rapid growth, and the growth rate of heavy and light trucks has been slightly slower. Among the main types of passenger cars, compared with the same period last year, the production and sales of large passenger cars have declined, and both medium and light passenger cars have increased, and the growth of light passenger cars is still significant.

New energy vehicle production and sales continue to break new records

In August, new energy vehicles continued to be a bright spot. Production and sales continued to grow month-on-month and year-on-year. Production and sales exceeded 300,000 units for the first time, setting a new record high, reaching 309,000 and 321,000 respectively, representing a month-on-month increase of 8.8% and 18.6%, year-on-year The increase was 1.8 times. From January to August, the penetration rate of new energy vehicles also continued to rise to a level of nearly 11%.

In August, the production and sales of pure electric vehicles were 252,000 and 265,000 respectively, a year-on-year increase of 1.9 times; the production and sales of plug-in hybrid vehicles were both completed 56,000, an increase of 1.4 and 1.7 times respectively; the production and sales of fuel cell vehicles were respectively Completed 40 and 38 vehicles, a year-on-year decrease of 58.8% and 68.6% respectively.

It is worth noting that the penetration rate of new energy vehicles in August has increased to 17.8%, and the penetration rate of new energy passenger vehicles is even closer to 20%. According to this development, my country is expected to achieve the mid- and long-term planning target of 20% of the new energy vehicle market in 2025 ahead of schedule.

From January to August, the production and sales of new energy vehicles were 1.813 million and 1.799 million, both increased by 1.9 times year-on-year. The cumulative sales penetration rate was close to 11%. Among them, the production and sales of pure electric vehicles were 1.512 million and 1.492 million, an increase of 2.2 times and 2.1 times respectively year-on-year; the production and sales of plug-in hybrid vehicles were 300,000 and 306,000, respectively, an increase of 1.1 times and 1.4 times respectively; The production and sales of fuel cell vehicles were completed at 724 and 733, respectively, up 27.7% and 26.8% year-on-year.

The top ten auto sales companies in the first August sold 14.267 million vehicles, accounting for 86.2% of the total auto sales. Among the top ten auto sales companies, compared with the same period in 2020, BAIC's sales volume declined slightly, while other companies showed varying degrees of growth, and Chery's growth rate was even more pronounced.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite