The "July 2021 Market Insights and Price Monthly Report" (hereinafter referred to as the "Report") released by the China Automobile Dealers Association and Guangzhou Wilson Information Technology Co., Ltd. (hereinafter referred to as the "Report") shows that in July, self-owned brands were less affected by the shortage of chips, and sales continued The performance was satisfactory; the joint venture market was affected by the "core shortage", and sales continued to fall; the luxury car market grew well and discounts continued to decrease.

"The shortage of chip supply has the greatest impact on joint venture brands. For chip suppliers, they mainly give priority to supplying joint ventures with relatively high profit margins, as well as new power companies with a relatively high degree of intelligence. Independent brands are more affected by chips. A little less, because part of the chips are supplied by domestic manufacturers, and import dependence is relatively low. In addition, the supply of joint venture brands is also occupied by luxury brands (some manufacturers give priority to ensuring the supply of luxury brands), so the structure of joint venture brands The sexual shortage will be more prominent.” On the afternoon of August 2, at the China Automobile Dealers Association's monthly situation analysis meeting, Lang Xuehong, deputy secretary general of the China Automobile Dealers Association, analyzed.

Joint venture car sales fell, luxury brand discounts decreased

With the effective control of the epidemic and the orderly recovery of the social economy, the overall retail sales of the passenger car market maintained a good upward trend in July. The main manufacturers of self-owned brands have performed well and continue to advance with leaps and bounds; under the influence of chip shortages and high base numbers, joint-venture brands have faced greater obstacles to the rise, and sales have continued to fall; consumption upgrades and high-end trade-in demand have continued to be strong, and luxury brands have maintained good growth.

Self-owned brands are less affected by the shortage of chips, and sales continue to perform satisfactorily. In June 2021, the independent market continued to advance by leaps and bounds, with a year-on-year growth of 27.5% in comparison with a low base; it is expected that strong growth will continue in July, and the growth rate will gradually slow down as sales gradually recover during the same period. The shortage of chips has little impact on the independent market, and the strong growth of new energy vehicles has also brought considerable growth. SAIC-GM-Wuling, BYD, GAC Aian, Weilai, etc. have all achieved rapid growth; in addition, the top brands Changan, Geely, etc. The offensive was also fierce, and jointly promoted the rise of the independent market.

“In July, self-owned brands continued to perform satisfactorily, driven by the strong growth of major manufacturers and new energy models. In terms of self-owned brand transaction prices, the slight decrease from June was mainly due to the impact of traditional gasoline vehicles. Therefore, the price index decreased by 0.3% month-on-month and the discount rate increased by 0.2%.

Affected by the "core shortage" in the joint venture market, sales continued to drop. Among the joint venture brands, demand for cars still dominates. With the complete layout of joint venture SUV products and the continuous decline in prices, the demand for joint venture SUVs has also maintained steady growth; in the same period last year, the joint venture market resumed growth after the epidemic, and the low base effect was eliminated. Superimposed on the impact of chip shortages, Volkswagen and Honda The production capacity of leading manufacturers such as Toyota, Toyota have been greatly affected, leading to the decline in the joint venture market. In July 2021, sales in the joint venture market continued to decline. Under the influence of insufficient inventory due to low production, terminal discounts were recovered. The joint venture market price index rose slightly from the previous month by 0.3%, and the discount rate decreased by 0.2%.

"In terms of price, the joint venture market has insufficient supply of vehicles affected by chips, and the price has risen slightly, and the discount rate has also been reduced." Chang Liang said.

The luxury car market is growing well, and discounts continue to decrease. In the luxury car market, consumption upgrades and high-end redemption demand continued to be strong. Even in June when the chip shortage caused grief, the retail volume still reached 331,000. The luxury market increased by 5.0% year-on-year and 2.1% month-on-month. In July, the overall luxury car market demand has entered the traditional off-season, and the probability of a sharp increase in terminal demand is low. As the comparison base rises from August to September, the growth rate will decline to some extent.

"I think there is still room for growth in the luxury car market. Although affected by chip shortages and the epidemic, the increase will not be so large, but the overall market is still going up step by step." Chang Liang said.

According to its forecast, the overall auto market has resumed growth in July, which is slightly better than in June. It is expected to go down from August to September, which will be the state of the overall market.

Major manufacturers adjust the pace of purchase and sales, and German brands have the greatest influence

The shortage of chips has led to delays in delivery of some models, and major manufacturers have adjusted their purchasing and selling rhythms.

The "Report" shows that the superimposed low base effect has faded and the growth rate has slowed. In order to stimulate market growth, dealers continue to export discounts. Under the influence of chip shortages in joint venture and luxury markets, some leading manufacturers in the joint venture and luxury markets have insufficient supply and price concessions. The price index has risen by 0.3% and 0.2% respectively; independent brand leading companies have strong industrial resilience and high ability to overcome chip shortages. The main force for the increase of new energy vehicles, sales volume maintained strong growth, terminal discounts were output steadily, and the price index dropped by 0.3%.

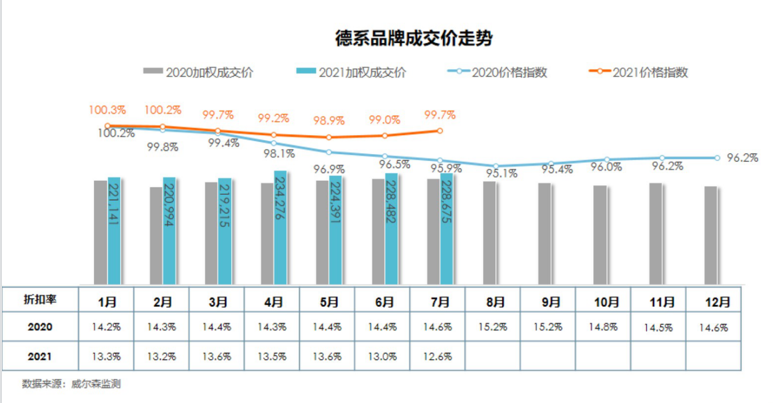

The performance of each brand is different. In July, under the influence of chip shortage, the price concessions of German brands were slightly recovered. The price index increased by 0.5% from the previous month, and the discount rate decreased by 0.4%; the price concessions of Japanese brands were slightly recovered, and the price index increased slightly by 0.1% from the previous month. The discount rate was basically the same as the previous month; the price index of American brands decreased slightly by 0.1% from the previous month, and the discount rate increased by 2.9%; the price index of French brands decreased by 0.5% from the previous month, and the discount rate increased by 0.3%; the price index of Korean brands The month-on-month decrease was 0.3%, and the discount rate was the same as last month; the price index of European brands decreased slightly from the previous month by 0.1%, and the discount rate increased by 0.1%.

"German brands are most affected by chips, and the supply of vehicles is seriously insufficient, including the Volkswagen system and several other brands. Japanese cars have been the least affected by chips due to stable trends in recent years and adjustments to the storage structure of accessories and parts. The rate is also relatively stable, basically the same as last month. The US brand has been growing in a difficult environment for the past two years, and continuously lowered prices. We can see that the US price in July fell by 0.1% compared with the previous month, and the discount rate decreased. French brands have been living and dying for the past two years, and the market discount rate has continued to decline. Korean brands are not particularly affected by chips, and the overall price is going down, and the discount rate is almost the same as last month.” Chang Liang analysis .

It is worth mentioning that from the perspective of production and sales, the impact of the epidemic on domestic industrial production is relatively weak. The pace of purchase and sales of major manufacturers is still affected by chips, and foreign countries are still severely affected by the epidemic, and the supply of imported cars is in short supply. From the perspective of market price index trends, discounts in the luxury car market continue to decrease, the overall consumer market environment is stable, and resource supply problems caused by chip shortages still affect most manufacturers, and some models continue to charge prices.

The chip supply shortage problem is still fermenting, and the problem may not be completely solved in a short time due to the impact of the epidemic. It should be noted that the most direct impact of the chip problem is the purchase of goods by manufacturers. At present, Mercedes-Benz and Porsche are deeply affected in the luxury car market. Some vehicles in mass production are not available, and the delivery cycle becomes longer, which affects the enthusiasm of car buyers. In view of this, the current strategy of many OEMs is to complete the sales and profit targets on schedule, and concentrate their production efforts on best-selling models and high-profit models.

Chang Liang suggested, "After the chip problem is solved, I hope that major OEMs can arrange production in an orderly manner based on the actual market conditions, and do not blindly expand production lines and sales in pursuit of sales goals." Lang Xuehong also called, "With the end of the third quarter chip The shortage has begun to ease, and dealers will enter the passive replenishment stage in the fourth quarter. Many manufacturers will increase production schedules to make up part of the gap in the first, second, and third quarters. As a result, dealers will likely Faced with high inventory pressure. I call on host manufacturers to carefully arrange production in the fourth quarter, and do not allow dealers to continue to deteriorate due to the rapid increase in inventory."

According to the "Report", it is predicted that with the effective control of the epidemic and the orderly recovery of the society and economy, the retail sales of the auto market will maintain a good upward trend, and the growth rate will slow down significantly from August to September and turn from positive to negative.

RCCN WeChat QrCode

RCCN WeChat QrCode Mobile WebSite

Mobile WebSite